A New Gilded Age for Private Markets?

A handful of dominant players are controlling secondary liquidity in private markets, leaving smaller LPs with few viable exit options. This article explores how the rise of DeFi and innovations like Pontoro’s Automated Liquidity Pool could reshape the balance of power and unlock more democratic access to liquidity.

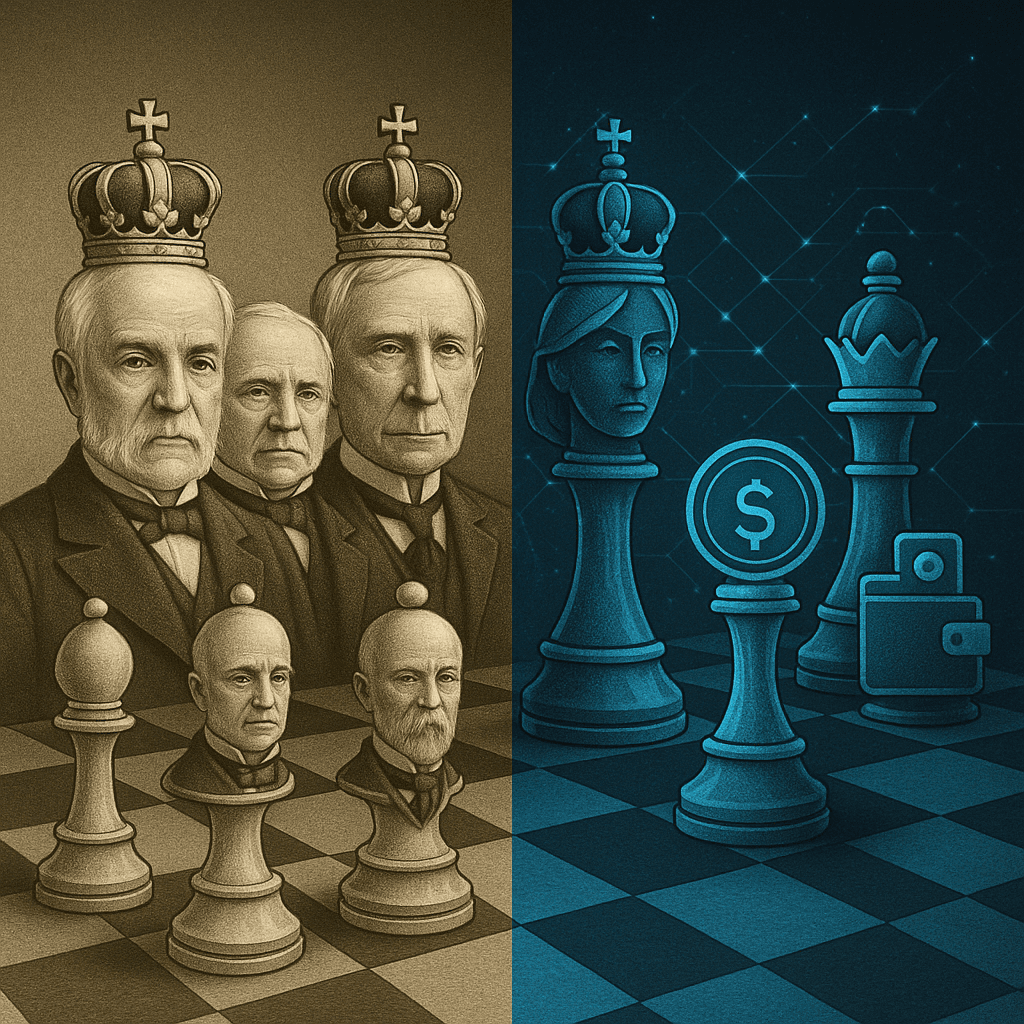

In the 19th century, a handful of very wealthy business owners, including names such as Andrew Carnegie, Cornelius Vanderbilt, John D. Rockefeller, and James J. Hill, controlled much of the U.S. economy. Through actions considered today to be monopolistic, these men restricted the production of goods to raise prices and increase their profits artificially.

Today, in the private markets fund industry, a similar phenomenon is occurring. A relatively small handful of firms are capitalizing on a liquidity crunch brought on by higher interest rates and a slow exit environment for private markets investments. LPs in aging private market funds are captive investors incurring high GP fees and operational costs. For those LPs seeking liquidity, the choices are narrow, and the cost, in terms of discounts these LPs are forced to swallow, is high.

Other avenues, such as bulletin boards, have generally not proven suitable as the number of sellers far outweighs the number of buyers, and 1:1 matching dramatically limits scalability. The most accessible exit routes are largely influenced by a select group of large private markets secondary players, who often require substantial discounts.

Indeed, according to Mercer (November 3, 2024), just 15 asset managers account for 80% of secondary deal volume, which totaled $150 billion in 2024 and is projected to reach $200 billion in 2025. In 2024, capital raised by secondary funds totaled $97.5 billion, and of that total, just three managers comprised over half at $52 billion. 1 Reminiscent of the influential figures during the Gilded Age, a handful of the biggest private markets secondaries asset managers play a similar role today in the private markets industry. Additionally, these managers generally provide liquidity only to large LPs with commitment sizes in the tens of millions, leaving many smaller, tail-end LPs without a liquidity option.

What if there were a better, more democratic, and distributed path to liquidity?

We believe the answer for LPs may lie in the intersection of the Decentralized Finance (“DeFi”) space with traditional finance (“TradFi”). A notable example in the DeFi space is the relationship between stablecoin holders and issuers. Stablecoins are being increasingly utilized for global, cross-border payments and for investment purposes (for example, some tokenized money market funds, such as one sponsored by Franklin Templeton, now accept fund subscriptions in stablecoins). The size of the stablecoin market as of April 2025 is $230 billion. It is projected to double in 2025 and reach between $2 and $3 trillion over the next 4-5 years.2 This rapid rate of growth in the stablecoin market is being driven by several factors, including a preference for stablecoins to make global payments, particularly in emerging markets with depreciating local currencies and less than stable financial systems, and, in the U.S., a new crypto-friendly administration.

With the increased use of stablecoins globally, there is a growing need for yield for stablecoin issuers and holders. As stablecoins must be pegged to a fiat currency such as USD on a 1:1 basis, there is no inherent yield or return to holding stablecoins. While these stablecoin holders can invest currently in money market funds such as the Franklin Templeton fund mentioned above, options to obtain a return above money markets are currently nonexistent. What these investors need is a short-term (e.g., 90 days) place to park their stablecoins while they are waiting to be deployed elsewhere and achieve a return above money market returns that is still relatively safe and stable.

We believe the size of the stablecoin market, in addition to other types of players in the DeFi space, fundamentally changes prospects for LP investors in private market funds who are seeking liquidity.

Pontoro is developing a patent-pending Automated Liquidity Pool (ALP) that provides scalable, algorithmically priced secondary liquidity for private markets fund LPs, offering a superior alternative to today’s bulletin boards and nascent exchanges. The ALP pools liquid capital from participants and deploys it into both liquid money-market funds and illiquid private fund interests. This first-of-its-kind solution eliminates the need for 1:1 counterparty matching for illiquid interest sellers and delivers enhanced yields of 2.00 – 4.50% above money market returns for liquid capital participants in a money-market-adjacent vehicle. Pontoro’s ALP will provide a unique opportunity to bridge the yield-enhancement needs of the DeFi market with the liquidity needs of top TradFi institutional private funds while unlocking significant economic growth opportunities for both sectors.

LPs seeking liquidity for their private markets fund interests are at a material disadvantage due to the significant imbalance between buyers and sellers. The relatively small handful of secondary fund players do not have nearly the capacity to absorb the buyers seeking liquidity. Bulletin boards don’t work effectively because 1:1 matching is highly difficult to achieve consistently. However, the massive size of the DeFi space and its novel innovations, represented in our example by the stablecoin market and holders looking for yield, introduce a new dynamic. Suddenly, there is a continuous flow of buyers in rolling 90-day tranches, facilitated by the capital flows as well as 24/7 running algorithmic pricing mechanisms that we believe may dramatically narrow the gap between sellers and buyers, thereby providing LPs seeking liquidity with a more palatable exit ramp.

The industry titans of the 19th century were eventually curtailed by the introduction of the Sherman Antitrust Act of 1890. Similarly, we believe that Pontoro’s ALP platform will do much to even the playing field between buyers and sellers of private markets fund interests.

1 Sources: Mercer, Secondaries Investor, Pitchbook2 Source: Coindesk